Barracuda Networks Acquires SKOUT Cybersecurity

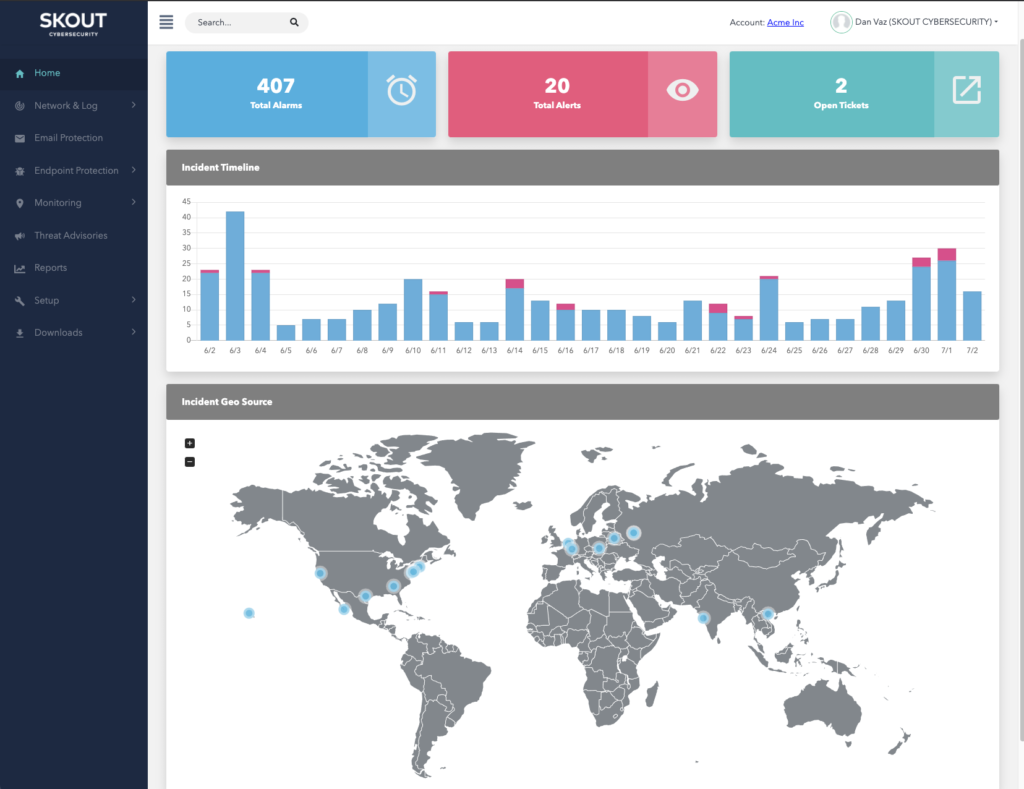

Barracuda Networks this week extended the scope of its cybersecurity portfolio by agreeing to acquire SKOUT Cybersecurity. SKOUT’s security operations center (SOC) service and extended detection and response (XDR) software is primarily made available via managed service providers (MSPs). Terms of the acquisition were not disclosed.

Neal Bradbury, vice president of MSP strategic partnerships at Barracuda Networks, said the addition of SKOUT Cybersecurity to the portfolio significantly extends the suite of data protection and security platforms the company already provides to MSPs.

In the wake of high-profile ransomware attacks and the COVID-19 pandemic that required the bulk of employees to work from home, the number of organizations that rely on MSPs to manage security has increased significantly in the last year, noted Bradbury. SKOUT Cybersecurity enables MSPs to provide those services without having to invest in building their own SOC.

The XDR software, meanwhile, provides Barracuda Networks with a way to gather security event data that can be integrated with the data collected from its firewalls and a set of zero-trust network access (ZTNA) tools it gained last year through the acquisition of Fyde.

Bradbury said SKOUT Cybersecurity has a small number of end customers to whom it sells its service directly. The immediate plan is to continue to make those services primarily available via MSP partners, said Bradbury. While larger enterprise IT organizations can afford to make extensive investments in cybersecurity, Bradbury noted most other organizations are going to increasingly consume security as-a-service.

Most of those services are now being delivered via cloud platforms that not only make it easier to manage cybersecurity from anywhere, but also provide a central point for aggregating the volume of data required to train artificial intelligence (AI) models that could be applied to cybersecurity.

MSPs that manage security on behalf of end customers have been around for decades. Thanks to the rise of the cloud, however, there are now more MSPs offering security and data protection services. The level of capital investment required for an MSP to deliver a security service has declined considerably.

Each organization will, of course, need to weigh the degree to which they want to rely on an external service versus managing security themselves. MSPs tend to have an economic advantage because the cost of maintaining security is spread across multiple customers; simultaneously, the amount of funding organizations are allocating to security continues to climb. Gartner forecasts worldwide spending on information security and risk management technology and services will grow 12.4% to reach $150.4 billion in 2021. That’s on top of a 6.4% increase in cybersecurity spending in 2020. The challenge is organizations are struggling to hire and retain cybersecurity talent because that talent often goes to work for an MSP. In fact, the degree to which organizations can afford to maintain cybersecurity on their own is becoming increasingly questionable.

Regardless of how cybersecurity is achieved, there’s never been more focus on the issue. The debate now is squarely on who, ultimately, should be responsible for achieving and maintaining it.