With the rapid increase in frequency and sophistication of cyberattacks in the last year, cybersecurity has never been more critical to maintaining the status quo for governments and organizations. So it only makes sense that vast amounts of money would start flowing into the industry.

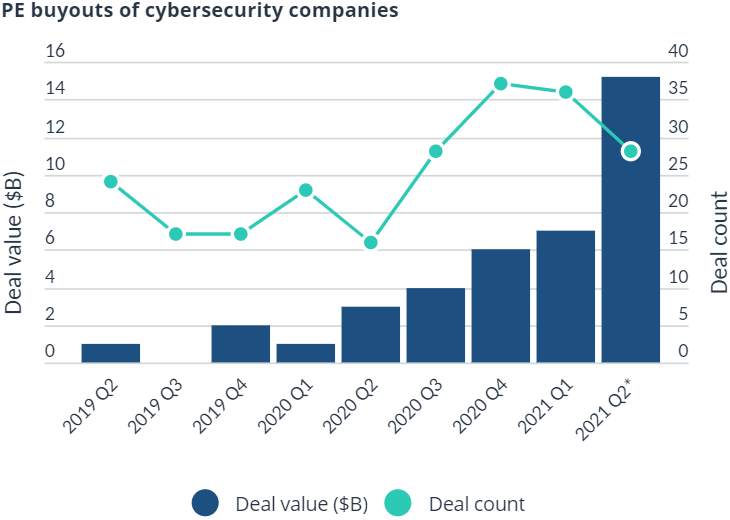

Private equity (PE) buyouts of cybersecurity firms are spiking and setting record high deals.

In April, Thoma Bravo acquired longtime SecureWorld sponsor Proofpoint for $12.3 billion, an all-time high price for a cybersecurity company. That deal was worth more than all cybersecurity buyouts from the second half of 2020 combined.

So far in 2021, cybersecurity buyouts have totaled over $23 billion.

Private equity buyouts of cybersecurity firms

PitchBook, a financial data and software company, has released a report looking into the rise in cybersecurity buyouts over the last two years.

The chart below was included in the report, showing how the number and value of deals has increased over the last nine quarters. The number of deals reached a peak in Q4 of 2020 at 37, while Q2 of this year has seen the value of deals skyrocket.

Thoma Bravo has been a significant contributor to the rise in deals, as it has completed buyouts of Imperva, Veracode, and Sophos in the last two years.

Jinny Choi, a private equity analyst at PitchBook, discusses why buyouts of cybersecurity companies will continue on an upward trajectory:

"I think the main reason for increased interest in cyber is because people are now really seeing a need for it. With significant cyberattacks in the last year, and remote work driving more enterprises and its employees online, the demand for online security is being heightened, with a focus on more specific and sophisticated technology.

It's impossible to say with confidence next year will be higher, but five years from now it certainly will be, as the industry matures and restructures to build subsectors, and as PE firms take notice of the attractive opportunities being created."

Choi also believes the pandemic has accelerated private equity buyouts of tech companies by five to 10 years. Technavio, a market research firm cited in the report, predicts the cybersecurity market will grow at an annual rate of 15% between 2021 and 2025.

For more information on private equity buyouts of cybersecurity firms, read PitchBook's analysis, Hackers, remote workers spur record PE investment in cybersecurity.