Cybersecurity threats are a growing menace, wreaking havoc on businesses and individuals alike. In this digital battlefield, cyber insurance has emerged as a crucial shield, offering financial protection against data breaches, ransomware attacks, and other cyber incidents.

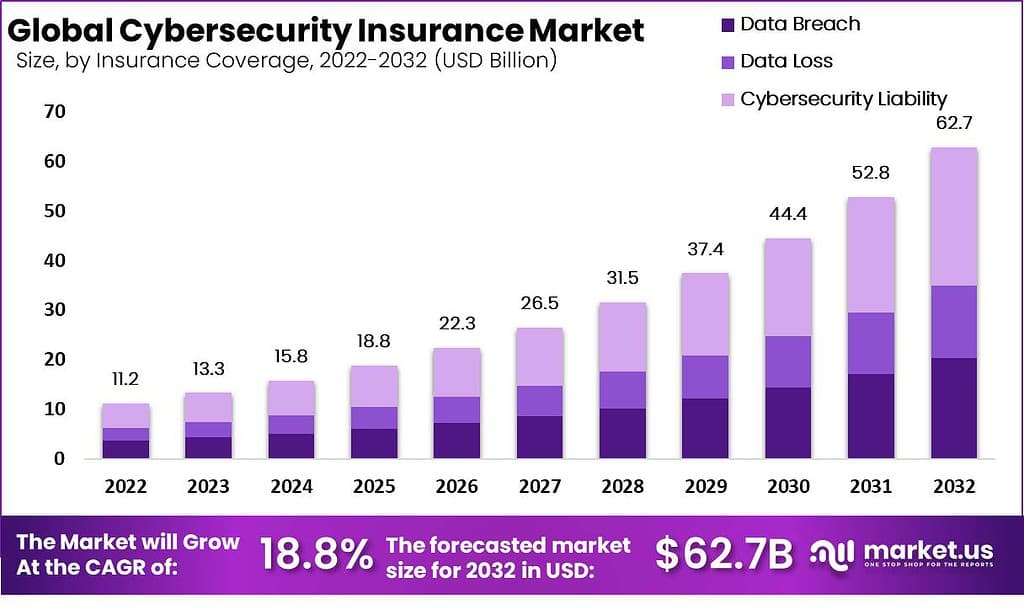

However, just as the threats evolve, so too does the cost of protection, with the global cyber insurance market projected to balloon to a staggering $90.6 billion by 2033, according to a recent report from Market.us Scoop.

This rapid ascent begs the question: what's driving the price hike, and are businesses fully prepared for the escalating cost of cyber defense?

A perfect storm of factors

Several factors are fueling the surge in cyber insurance costs, including:

-

Increased frequency and severity of cyberattacks: As cybercriminals refine their tactics and exploit vulnerabilities, data breaches and ransomware attacks are becoming more commonplace, leading to costly payouts for insurers.

-

Rising claims: As the number of attacks increases, so do the claims filed by policyholders. This puts a strain on insurance companies, who are forced to adjust premiums to maintain solvency.

-

Expanding coverage: Cyber insurance policies are evolving to cover a wider range of risks, including business interruption, regulatory fines, and crisis management. This broader scope naturally translates to higher premiums.

-

Data limitations: Accurately assessing cyber risk remains a challenge due to limited data. This lack of clarity makes it difficult for insurers to price policies accurately, often leading to conservative estimates and higher premiums.

Experts sound the alarm

Cybersecurity professionals echo these concerns, highlighting the complexities of the current landscape.

"In our research on cyber insurance, we found that insurance prices have increased significantly and that most companies who get cyber insurance ultimately use it and with many using it multiple times," said Joseph Carson, Chief Security Scientist and Advisory CISO at Delinea.

Further emphasizing the data dilemma, Dan Palardy, Lead Actuary at Cowbell, states, "Obtaining specific, reliable data remains a hurdle, especially for SMEs, impeding their ability to gain necessary insights due to a lack of uniform data governance."

Preparing for the future

With cyber insurance costs on an upward trajectory, organizations must proactively strengthen their cyber defenses to mitigate risks and potentially lower premiums. This includes:

- Implementing robust security measures: Employing multi-factor authentication, strong encryption, and regular vulnerability assessments can deter attackers and minimize potential damage.

- Adopting a proactive risk management approach: Regularly evaluating and updating cybersecurity policies, conducting employee training, and staying abreast of emerging threats are key to staying ahead of the curve.

- Partnering with a reliable cyber insurance provider: Choose an insurer with a strong track record in cyber risk assessment and claims processing to ensure adequate coverage and support.

The evolving world of cyber threats demands constant vigilance and adaptation. By proactively strengthening their cyber defenses and carefully navigating the evolving cyber insurance landscape, organizations can weather the storm of rising costs and emerge stronger in the face of digital adversaries. Remember, prevention is always cheaper than the cure.

Follow SecureWorld News for more stories related to cybersecurity.