Today, the U.S. Federal Trade Commission (FTC) ordered Intuit to stop promoting its software products and services as "free" unless they're actually free for all consumers.

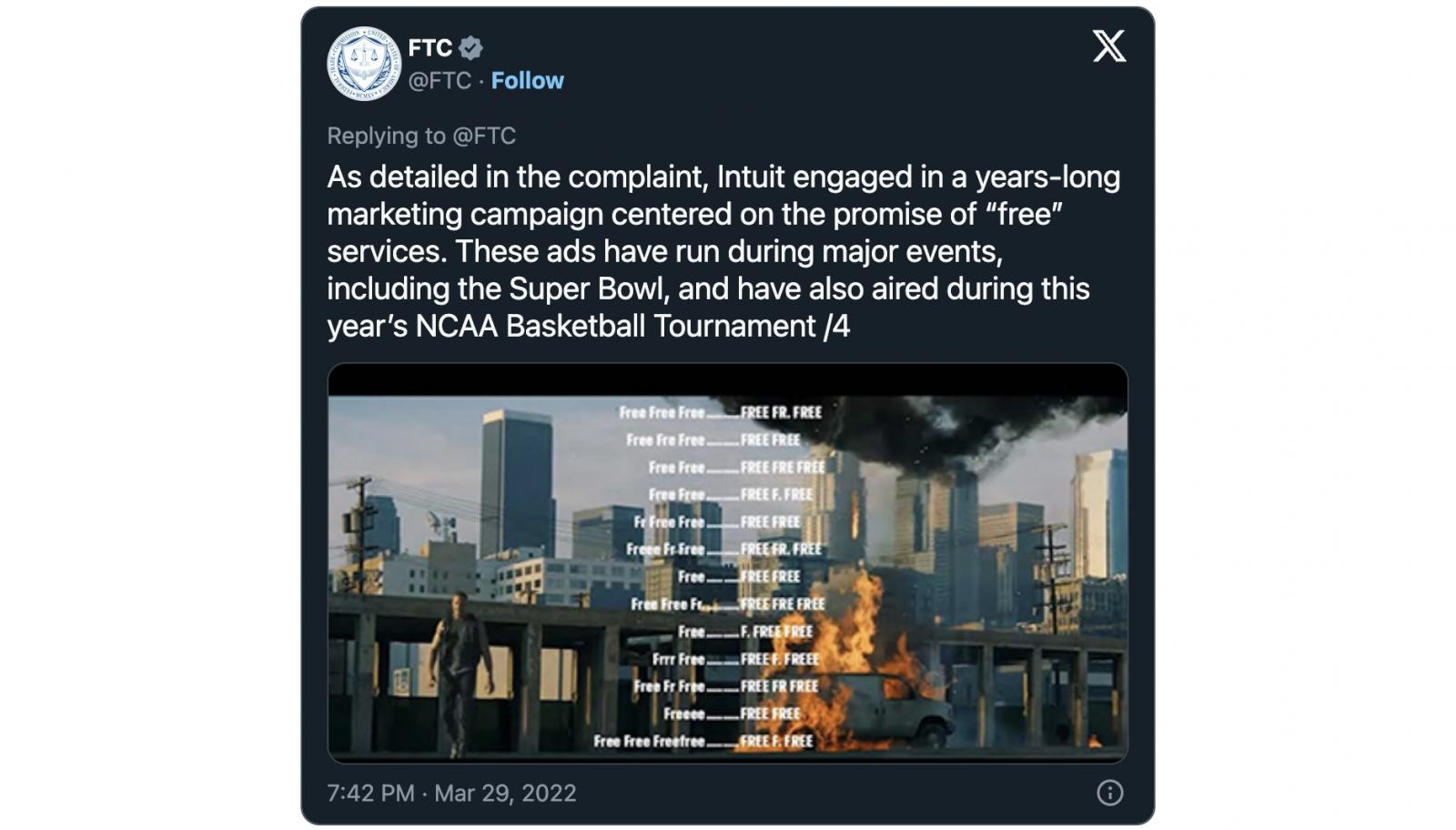

The order comes after the consumer protection watchdog's investigation into how Intuit promoted its tax preparation software TurboTax as being a "free" product as part of a years-long deceptive advertising campaign, including ads shown during the Super Bowl and the 2022 NCAA Basketball Tournament.

However, the ads were misleading as millions of Americans couldn't use Turbotax to file their taxes for free over the years, finding that it was all just a waste of time.

As the FTC said, around two-thirds of all tax filers in the U.S. could not use TurboTax for free as advertised by the accounting and tax software provider, instead being hit with charges when it was time to file.

"TurboTax is bombarding consumers with ads for 'free' tax filing services, and then hitting them with charges when it's time to file," said the Director of the Bureau of Consumer Protection Samuel Levine, two years ago, when FTC filed its lawsuit against Intuit.

Today's order should stop misleading TurboTax "free tax filing" ads, as it prohibits Intuit from running ads for "free" tax products and services for which many Americans are ineligible.

"The Commission's Final Order prohibits Intuit from advertising or marketing that any good or service is free unless it is free for all consumers or it discloses clearly and conspicuously and in close proximity to the 'free' claim the percentage of taxpayers or consumers that qualify for the free product or service," the FTC said on Monday.

"Alternatively, if the good or service is not free for a majority of consumers, it could disclose that a majority of consumers do not qualify. The order also requires that Intuit disclose clearly and conspicuously all the terms, conditions, and obligations that are required in order to obtain the 'free' good or service."

The FTC's order also bars Intuit from providing false information concerning significant aspects of its products or services, including but not limited to pricing, refund policies, consumers' eligibility for tax credits or deductions, and the ability to accurately file taxes online without reliance on TurboTax's paid service.

Americans with adjusted gross incomes of $79,000 or less can use products available through the IRS' Free File Program to file federal and state tax returns for free.

In a statement sent to BleepingComputer after the article was published, Intuit's Senior Manager for Communications Tania Mercado said that FTC's order was the result of a "deeply flawed decision" and that the company had already filed an appeal.

"Absolutely no one should be surprised that FTC Commissioners - employees of the FTC - ruled in favor of the FTC as they have done in every appeal for the last two decades," Mercado said.

"This decision is the result of a biased and broken system where the Commission serves as accuser, judge, jury, and then appellate judge all in the same case. Intuit has appealed this deeply flawed decision, and we believe that when the matter ultimately returns to a neutral body Intuit will prevail."

Update January 23, 07:00 EST: Added Intuit statement.

Comments

bazbsg - 3 months ago

So Intuit would rather appeal and continue with their misleading advertising than just do the right thing?

I bought Turbotax in December to do some end of the year tax planning. But the software wasn't ready until Jan 17 so I couldn't do a proper calculation so I missed the Dec 31 deadline to make important decisions that could have saved me taxes.

steve.tabler - 3 months ago

Last year, there was a posting somewhere about several Tax Services having their servers hacked and putting at risk a large number of returns. Turbo-Tax was conspicuously absent from that list, and in hindsight I'm glad I used them. Turbo-Tax did make a technical error on my tax return, and required the technical error in order for my tax return to be e-filed. I filed a report with Turbo Tax management about it, but I've had no feedback that it has been corrected and I expect to have a repeat of the incident again.

Icepop33 - 3 months ago

Boy, they're getting brazen with their adversarial attitudes now. Of course, there is nothing we can do to remove her from the responsible position she holds but is not qualified for, so lie to me and tell me you mean well, just like the old days lol. This tool Mercado is miffed that a watchdog agency (ideally and at present) has ruled in favor of the American people. How dare they!