A Cyber Insurance Backstop

Schneier on Security

FEBRUARY 28, 2024

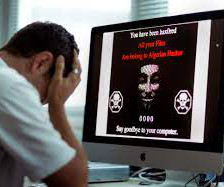

One possible solution, touted by former Department of Homeland Security Secretary Michael Chertoff on a recent podcast , would be for the federal government to step in and help pay for these sorts of attacks by providing a cyber insurance backstop. But this is easier said than done.

Let's personalize your content