Hackers stole millions of dollars from Uganda Central Bank

Security Affairs

NOVEMBER 30, 2024

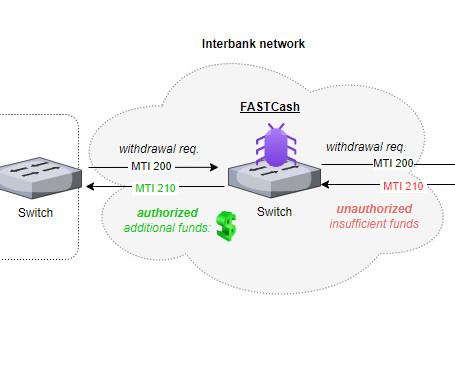

Financially-motivated threat actors hacked Uganda ‘s central bank system, government officials confirmed this week. Ugandan officials confirmed on Thursday that the national central bank suffered a security breach by financially-motivated threat actors. The Daily Monitor newspaper reported that the attackers stole 47.8

Let's personalize your content