Report: Big U.S. Banks Are Stiffing Account Takeover Victims

Krebs on Security

OCTOBER 7, 2022

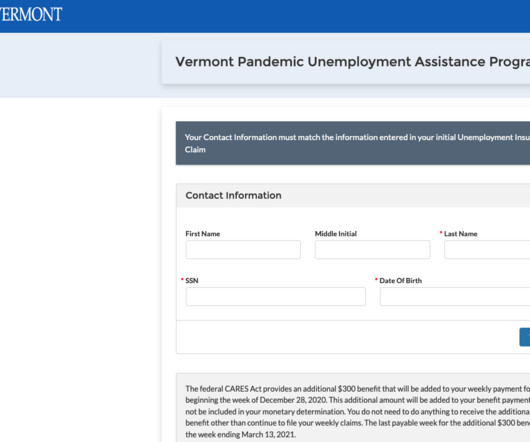

consumers have their online bank accounts hijacked and plundered by hackers, U.S. But new data released this week suggests that for some of the nation’s largest banks, reimbursing account takeover victims has become more the exception than the rule. Bank , and Wells Fargo.

Let's personalize your content