Japan ’s FSA warns of unauthorized trades via stolen credentials from fake security firms’ sites

Security Affairs

APRIL 22, 2025

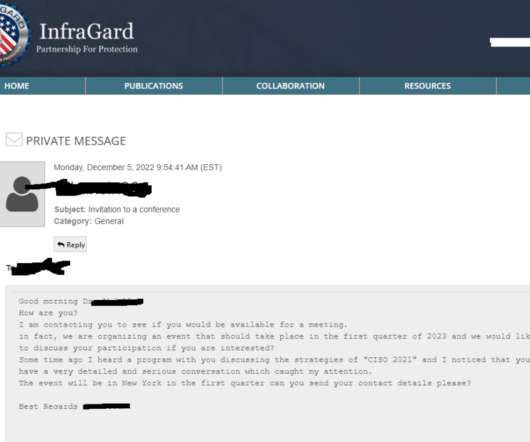

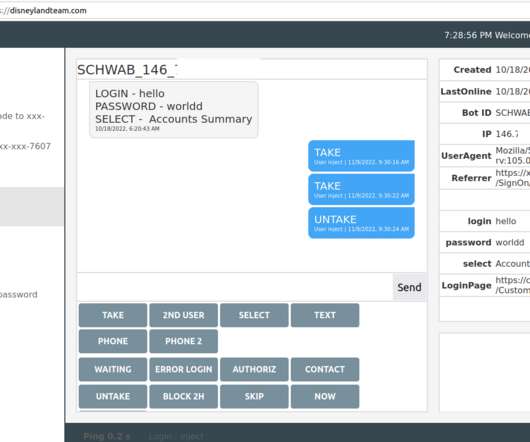

Japan s Financial Services Agency (FSA) warns of hundreds of millions in unauthorized trades linked to hacked brokerage accounts. Japan s Financial Services Agency (FSA) reported that the damage caused by unauthorized access to and transactions on internet trading services is increasing.

Let's personalize your content