Protect your business with security awareness training

SiteLock

AUGUST 27, 2021

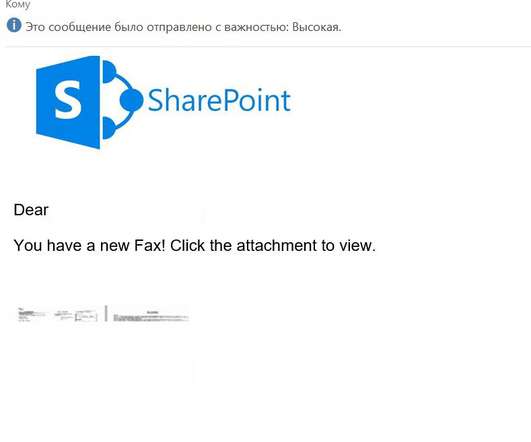

Cybercriminals know this, which is why phishing attacks account for more than 80% of reported security incidents and why 54% of companies say their data breaches were caused by “negligent employees. ”. In fact, the most popular time for criminals to send emails targeting workers with funds-transfer scams is 9 a.m. on a Tuesday.

Let's personalize your content