Defending Against Known, Unknown & Unknown-Unknown Email Scams

Security Boulevard

MAY 3, 2023

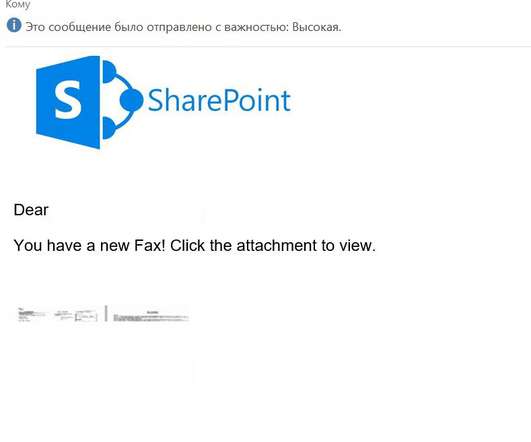

Phishing scams pose a significant risk to companies and can lead to great loss in the form of stolen account credentials, fraudulent payments and corporate data breaches, among others. The post Defending Against Known, Unknown & Unknown-Unknown Email Scams appeared first on Security Boulevard.

Let's personalize your content