Cyber Insurance Costs Soaring: Is Your Organization Covered Enough?

SecureWorld News

JANUARY 11, 2024

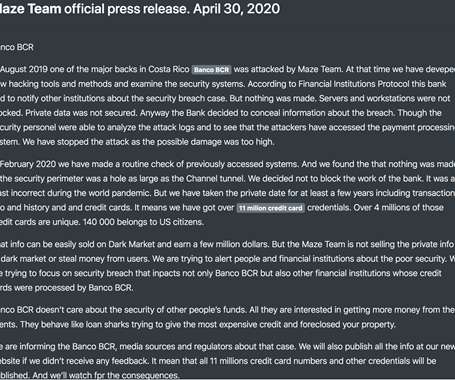

Cybersecurity threats are a growing menace, wreaking havoc on businesses and individuals alike. In this digital battlefield, cyber insurance has emerged as a crucial shield, offering financial protection against data breaches, ransomware attacks, and other cyber incidents.

Let's personalize your content